Trade Tensions & Portfolio Protection: Strategic Asset Allocation in a Shifting World

#9 – April 2025 – 04/15/2025

This newsletter is for informational purposes only and is not intended to be financial advice.

Macro Insights

United States

It’s not news that markets have been highly volatile over the last few months. Fears of the fallout from President Trump’s trade war have caused economists, and even the Atlanta Fed, to lower estimates for GDP, with many predicting we’re about to be in a recession. With so much day-to-day noise, I think it’s beneficial to take a step back and look at the long-term events that led to where we are today.

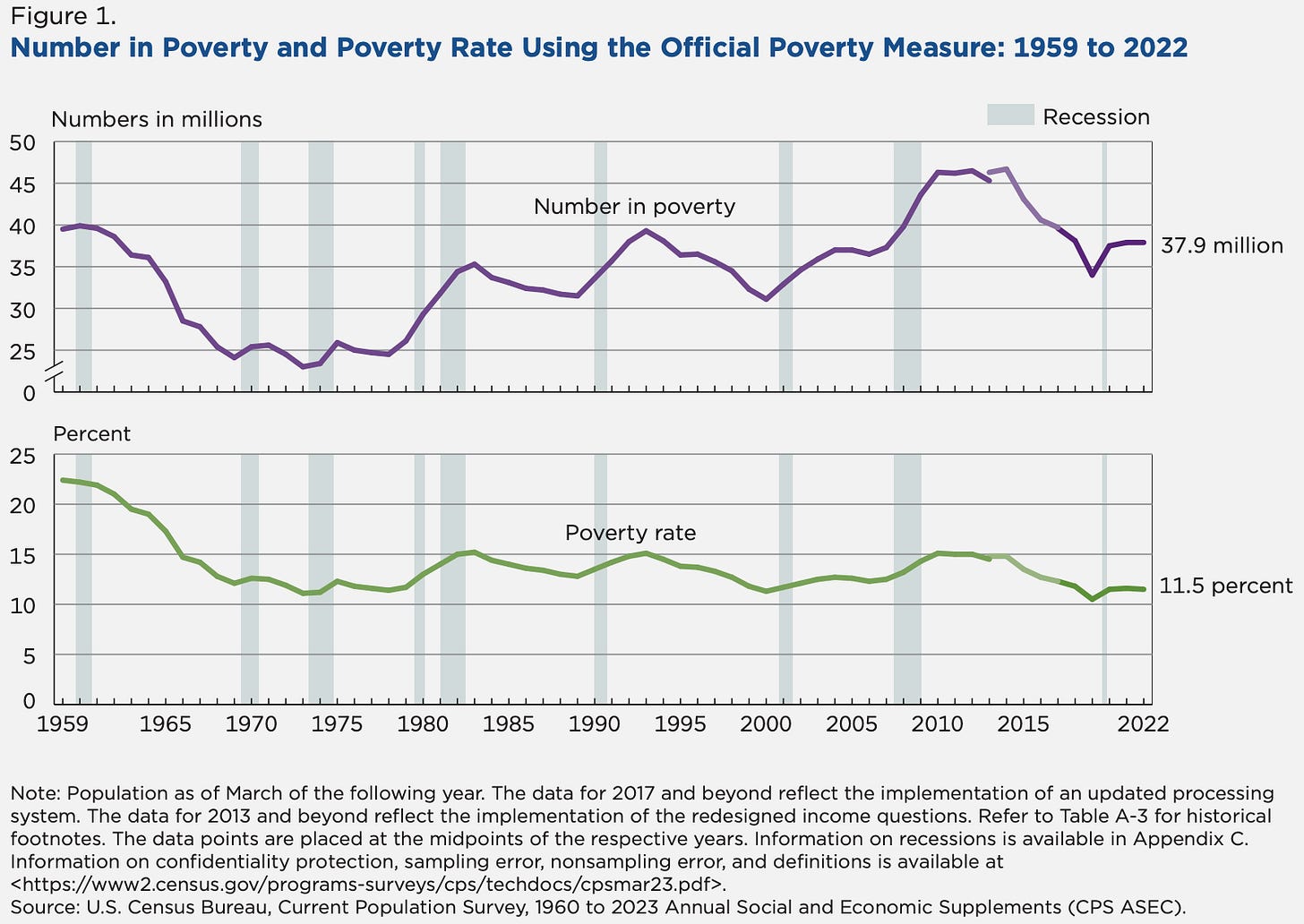

It doesn’t take long to realize there is massive wealth inequality in America. In 2022, over 11% of Americans, or 37.9 million people, were living in poverty – almost double the number of people living in poverty in the 1970s. Surprisingly, for the world’s “wealthiest” nation, the poverty rate is relatively flat over the past 50 or so years.

Another troubling set of facts is that 1 out of 10 Americans has not finished high school, and almost half of Americans do not have a college degree. Real median weekly earnings have also risen by a measly 12% since 2000 - that’s an annual increase of half a percent. Pres. Trump has been exclaiming that the middle class in America has been hollowed out over the last few decades. It’s precisely this demographic that helped him win the most recent election – where 62% of rural voters voted Republican. Furthermore, life expectancy in America is falling – something that should not be the case for the “wealthiest” nation on earth.

Another major point of concern that Trump has been emphasizing repeatedly is the trade deficit. It’s clear that the United States has been in a trade deficit for over 30 years now. The implications of a trade deficit are important. Think of it this way: if you were spending more than you were making for 30 years, what type of a financial position would you be in? Probably a terrible one! The U.S. has been able to make this work because of the strength of the country, in terms of its military, rule of law, and the breadth of technological innovation. Essentially the U.S. has been very productive and strong for quite some time, but in terms of actual wealth, the trade deficit has redistributed America’s wealth globally and much of the perceived “wealth” is now actually debt.

There’s another intriguing statistic called the net investment position of a country. It incorporates two things: i) the accumulated value of U.S.-owned financial assets in other countries, and ii) U.S. liabilities owed to residents of other countries. Essentially this stat is the difference between the U.S.’s assets globally (i) and the liabilities they owe to foreigners (ii). This figure has been on the decline, almost tripling over the last ten years. Part of that is due to U.S. assets being much more attractive to both domestic and global investors. U.S. investors prefer to own U.S. assets rather than foreign assets, and foreign investors have also preferred U.S. assets over other countries. According to the U.S. treasury department, foreign investors owned almost 20% of U.S. stocks as of 2023 – a record-high going back to 1945.

Essentially, President Trump has been making the case that the “wealthiest nation on earth” is not as wealthy as it may seem, but rather has redistributed much of their wealth abroad, through the large trade deficits that America has been experiencing for quite some time. He argues this is one of the main causes for wealth inequality and poor standards of living among the middle class. His administration has also pointed to “unfair trade barriers/advantages” that other countries have relative to the U.S. Tariffs are just one form of a trade barrier, but his administration has argued that there are also other more indirect forms of unfair trade advantages. One example they provide of that, is the Hukou system in China, which registers families and individuals, and assigns various restrictions to them, both in terms of social and economic benefits. For example, rural hukou holders are often limited in their access to education, giving them a disadvantage in the job market, and a subsequent advantage to urban hukou holders. What they argue this has done to the manufacturing industry is keep costs extraordinarily low by essentially ensuring that the Chinese manufacturing industry always has access to cheap labour, creating an artificial competitive advantage.

My intent in this section is simply to look at the motivations of key players in the macroeconomic environment, and develop an understanding of the reality of where we currently are. I hope that an understanding of what’s driving U.S. leaders will help investors make better investment decisions.

Now that we understand the motivations for reorganizing global trade, I want to briefly think about where things are headed. I think the President’s goal has been to pressure the vast majority of countries to essentially form new alliances. His method of issuing across-the-board tariffs is intended to create a sense of urgency, similar to when you watch detectives and prosecutors in movies who put criminals in separate rooms and tell them whoever talks first gets the best deal. There’s motivation for countries to be the first to act and come to the table, since they believe they will be able to get a better deal and bring investment to their own country. We’re seeing this happen with Vietnam and South Korea, the latter in particular has seemed to make a 180 degree turn from their original stance of responding jointly with China and Japan. South Korea has now said they are not going to fight back against tariffs like China has done. They seem to believe that they will be able to take advantage of China, and get a better deal, in essence moving U.S. trade from China to other parts of the region.

It's too early to say how this will all play out, and who “wins” in the end is very uncertain. Global trade will certainly be reorganized, and I feel the relationship between the U.S. and various countries like China, and even Canada, may become fractured beyond repair. The Spanish Prime Minister recently announced that Spain favors a more balanced and cooperative relationship between the EU and China, in a sign that alliances might be beginning to shift.

The bond market is showing worrying signals that the U.S. administration should be very careful right now. As of this weekend, thirty-year U.S. bond yields were up a staggering 57.5 basis points since April 4th. There is much talk about who is doing the selling – with China directly in the crosshairs. Some strategists in the bond market think that China may be selling U.S. treasuries in retaliation for the tariffs, which would come at a cost to China in the form of a negative impact on the value of its foreign reserves. This is worrying because as I have talked about previously, America’s debt levels are already incredibly high, and the risk of the debt not being rolled over is growing increasingly worrying – something I am sure is on Treasury Secretary Bessent’s mind as he has to roll over 9-10 trillion USD of debt this year at the lowest interest rate possible. With tensions rising around the world, what were once regarded as some of the safest assets in the world–US Treasuries, may be losing their “safe haven” appeal as investors require higher yields. The U.S. relies on the ability to roll over its debt, since it’s virtually impossible for it to pay it back, without devaluing the US dollar.

The U.S. stands at a pivotal moment in history, and although its economy and technological innovation is extremely important to the world, it does not exist in a bubble. While tariffs might help bring some wealth back to America in the short term, they pose the risk of reorganizing world alliances over the long term. America would do far better by working with others, rather than against them. My personal opinion is that the Trump administration will work out a deal with a broad number of countries in the near future because it is in their best interest to do so. The President has already showed his hand by pausing tariffs after the market began to have a meltdown. With tons of uncertainty around how countries will be able to position themselves, it’s more important now than it has ever been for investors to be well diversified – not just among asset classes but also geographically.

Asset Allocation

With all the uncertainty in financial markets at the moment, I thought it would be prudent to give my thoughts around how I am looking at allocating to various asset classes rather than individual equities. What you will find below is: i) a list of various asset classes and geographies, ii) my weighting for that class/geography in a portfolio, and iii) a brief commentary to explain my thoughts on that specific asset class/geography.

Thank you Louis! You have very clear and thoughtful ideas for global investors that need to better understand implications regarding the recent trade tensions. I especially appreciate your detailed overview on the reality for middle class Americans. It is easy for many investors to overlook these factors, exclusively focusing on the daily Trump drama instead. I found your article very helpful. 🙏😊